Are your Trauma Center Billing Practices Putting you at Risk?

Verified Trauma Centers are a key health care asset to the communities that they serve. At the most basic level, a Trauma Center offers total care for every aspect of injury—from prevention through rehabilitation and including issues of immediate survival. Formal verification for a Trauma Center is evaluated by the American College of Surgeons (ACS) and, although the verification process is a large financial commitment, it indicates a high level of standards and care during emergency and sometimes life-threatening situations.

In 2002, due to the high costs of becoming a designated trauma center, lobbyists proposed and succeeded in the implementation of fees for trauma response and trauma critical care beds. Since then, there has been little to no regulation regarding how these fees are set by each institution and little to no review on the correct applications of these fees by the CMS. This has resulted in ranging from $1,000 – $61,7341 per patient.

In 2022 the Office of the Inspector General (OIG) announced the concern for Medicare overpayments based on trauma activation fees that fall into one of two categories2:

- Trauma centers billing trauma activation fees that were medically not necessary, and

- Hospitals that are not verified or designed as trauma centers utilizing the trauma activation charges. The OIG has announced they will investigate these concerns during the 2024 calendar year.

How to ensure compliance with trauma billing

Whether your hospital is a new trauma center or has been designated for years, there are key industry best practices for trauma billing which will require input from both operational and financial leaders.

Who can bill trauma activation fees?

- Hospitals designated as a Trauma Center by the state’s designation authority.

OR

- Hospitals verified as a Trauma Center by the ACS.

How should you bill trauma activation fees?

There are two major steps before being able to accurately bill for trauma activation fees. Any trauma center should have these thoroughly completed before billing occurs.

- Set the rates for your Trauma Activation Fees

- This should be based on a thoughtful process of evaluating your “cost of readiness,” meaning how much does it cost you to be ready to accept a trauma patient 24/7/365 The most common practice is to have a two-tier activation:

- Highest level- entire trauma team responds to the trauma bay and the OR prepares.

- Lower level- certain members of the trauma team respond and the OR is aware.

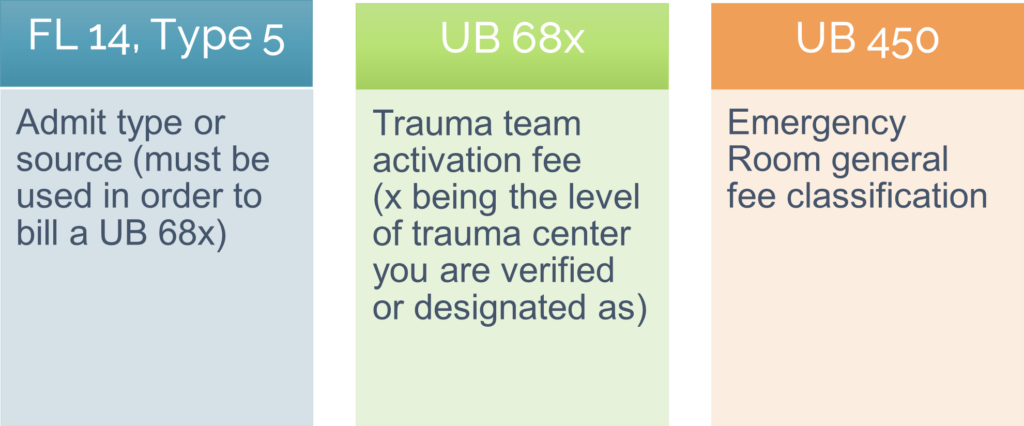

- Have your revenue cycle team set up the proper billing codes, which include:

What patients qualify for a trauma activation fee?

A patient can qualify for a trauma activation fee if they meet the hospital’s published trauma activation criteria, or if the hospital received a pre-hospital notification from EMS, Fire, Police, or a referring facility that the patient was coming.

Trauma Activation Criteria – key considerations

Does your criteria meet minimum requirements from the ACS?

It is important to have a specified response team and track data on their response, including presence and timeliness. This should be constantly evaluated by the Trauma Program to ensure the correct team is responding timely for care of the most critical trauma patients. If you are not able to prove through documentation that the trauma team was present, then billing for the activation fees could be problematic.

What’s new? Upgrades and Downgrades in Trauma Activations

A trauma activation should be evaluated on patient arrival for the need to upgrade or downgrade based on how the patient is presenting. Patients can be upgraded or downgraded upon arrival depending on the nature and extent of their injuries.

If the trauma activation is downgraded, billing should reflect the downgraded status. Trauma Activations should not be upgraded after all diagnostics have been completed.

Conclusion

It is still unclear how CMS will utilize the OIG report once it’s finished, but it could result in financial implications to your center if the above outline is not considered.

More consistent oversight and guidance is intended to improve the quality of care at trauma centers across the country. With the OIG ramping up investigations into trauma activation charges, hospitals need to consider the following:

- A detailed billing review of all their trauma billing, including:

- FL 14 Type 5

- UB 68X

- UB 450

- Chargemaster Review – if a recent change in level of trauma designation/verification has occurred, charges should be reviewed to ensure they are reflecting correctly.

- Ensure trauma activation charges are derived from a thoughtful process of evaluating cost of readiness.

- Regular reviews of trauma activation criteria and accuracy of trauma triage rates that are completed by the trauma program.

Want to learn more?

The BNN Healthcare Advisory team specializes in proper billing and coding guidance across the continuum of care. If your healthcare organization is experiencing challenges with the trauma activation billing process, looking to better understand the changes detailed in this article, or interested in learning more about improving your processes, technology, and strategy, get in touch with our healthcare industry specialists today! You can also learn more about our healthcare industry solutions here.

References:

1 Zitek T, Pagano K, Mechanic OJ, Farcy DA. Assessment of Trauma Team Activation Fees by US Region and Hospital Ownership. JAMA Netw Open. 2023 Jan 3;6(1):e2252520. doi: 10.1001/jamanetworkopen.2022.52520. PMID: 36692878; PMCID: PMC10408274.

From <https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10408274/>

2 https://oig.hhs.gov/reports-and-publications/workplan/summary/wp-summary-0000742.asp

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.