How to Monetize Inflation Reduction Act Credits for Financial Institutions

Recently, I had the great opportunity to speak at the Northern New England CFO Meeting, hosted by the Maine, New Hampshire, and Vermont Bankers’ Associations. At that conference, my colleague Dan Gayer and I spoke about tax credits from the Inflation Reduction Act and how they can be applicable for financial institutions. This article is a follow-up to that presentation and provides further insights into the ability of financial institutions to be players in the market, especially regarding the transferability of said tax credits.

Background on the tax credits and the Inflation Reduction Act can be found in two of our prior articles here:

Green Energy Incentives in the Inflation Reduction Act of 2022

Tax Features of the Inflation Reduction Act of 2022

Understanding Transferable Tax Credits

What Are Transferable Tax Credits?

Transferable tax credits are incentives provided by the government to promote specific activities, such as clean energy production. These credits can be transferred from the original recipient (e.g., a solar developer or wind farm owner) to a third-party buyer (the financial institution). Payment for the credit must be in cash. Credits may only be transferred once but can be sold in full or as a portion of the credit. Eligibility depends on the type of credit. There are several benefits to transferring credits, and we’ll get into those a bit later in this article.

Types of Transferable Credits

Financial institutions can purchase various types of transferable credits, including:

- Energy Credit (48), (Form 3468, Part VI)

- Clean Electricity Investment Credit (48E), (Form 3468, Part V)

- Renewable Electricity Production Credit (45), (Form 8835, Part II)

- Clean Electricity Production Credit (45Y)

- Zero-emission Nuclear Power Production Credit (45U), (Form 7213, Part II)

- Advanced Manufacturing Production Credit (45X), (Form 7207)

- Clean Hydrogen Production Credit (45V), (Form 7210)

- Clean Fuel Production Credit (45Z)

- Carbon Oxide Sequestration Credit (45Q), (Form 8933)

- Credit for Alternative Fuel Vehicle Refueling/Recharging Property (30C), (Part 8911, Part II)

- Qualified Advanced Energy Project Credit (48C), (Form 3468, Part III).

Benefits of Investing in Transferable Credits

There are several potential benefits of investing in transferable credits. Transferable credits can provide diversification beyond traditional financial instruments. Clean energy credits can help financial institutions contribute to a cleaner environment and support their ESG goals, particularly in a bank’s local community.

Let’s say, for example, that a bank has decided that 5% of their annual book income should go toward clean energy efforts as part of their ESG strategy. In that case, a bank with net income of $10,000,000 would want to invest $500,000 into clean energy. One strategy could be to find a developer (perhaps a customer of the bank already or recommended by a trusted advisor) who has clean energy credits that they are looking to monetize and would sell to the bank. In that case, the bank might be able to meet its 5% ESG goal while also reducing its corporate tax burden via tax credits (almost as if, instead of putting money directly into an investment, they paid the IRS to reduce a tax burden, similar to a quarterly estimated tax payment).

Income related to transferable credits is tax-exempt (i.e., the spread between the value of the credit and the purchase price).

Transferable credits can also potentially assist with effective tax rate planning and can be used as a mechanism to finance projects and provide a loan to a bank.

Let’s run through an example. If a bank has the following facts:

- $10,000,000 pre-tax income

- $100,000 of nondeductible expense

- $500,000 of tax-exempt income

- Looking to buy $1,000,000 of solar credits for $900,000

Without the solar credit, assuming no state taxes for simplicity’s sake, the effective tax rate would be 17%, as illustrated below:

| Description | Dollar Amount | % of Income |

| Pre-tax income @ 21% tax rate | 2,100,000 | 0.2100 |

| Unallowable deductions | 100,000 | 0.0100 |

| Tax-exempt income | (500,000) | -0.0500 |

| TOTAL | 1,700,000 | 0.1700 |

With a purchase of a transferable tax credit of $1,000,000 for $900,000, the effective tax rate would move to 16%, as illustrated below:

| Pre-tax income @ 21% tax rate | 2,100,000 | 0.2100 |

| Unallowable deductions | 100,000 | 0.0100 |

| Tax-exempt income | (500,000) | (0.0500) |

| Tax credit – Purchase price less credit value | (100,000) | (0.0100) |

| TOTAL | 1,600,000 | 0.1600 |

This results in a tax savings for the bank of approximately $100,000 and contributes to positive change within their community related to sustainability and clean energy access.

How to Purchase Transferable Credits

Once you have decided that you would like to purchase transferable credits, the first step is to conduct due diligence to identify an appropriate option. During due diligence, institutions should assess the credit’s validity, expiration date, and compliance with regulations, paying particular attention to wage and apprenticeship requirements. It is also important to confirm the validity of any bonus incentive credits (low-income communities, energy communities, or domestic content). This includes if applications were made for a low-income community bonus credit (the 2024 window for low-income community bonus credits recently opened). Before purchasing a credit, buyers should fully understand the tax implications for the institution and any tax credit capacity issues.

After a credit has been identified, the next step is negotiating the price with the seller. Purchase prices are determined by market rates and the credit’s value. When deciding to purchase a credit, buyers should also consider the rate of return and their ability to use the credit in a timely manner. After agreeing to a price, the purchase agreement can be drafted.

It is important to remember that sellers must complete electronic pre-filing registration with the IRS. This will include providing information about the taxpayer, the intended eligible credits, and the eligible credit project. Upon completing this process, the IRS will provide a registration number for each eligible credit property. This registration number must be provided to the buyer with all other information necessary to claim the transferred eligible credit. The pre-filing must be completed in sufficient time to have a valid registration number when the seller files their tax return.

Sellers also need to ensure they satisfy all requirements to earn the eligible credit for the tax year. For example, a solar energy project would need to be placed in service prior to earning an eligible credit. They are required to complete a transfer election statement with the transferee.

Finally, sellers need to file a tax return for the taxable year in which the eligible credit is taken into account by you, the purchaser, under the rules of section 6418 and include the transfer election statement and other information as required by guidance. The tax return must include the registration number for the relevant eligible credit property.

Accounting for transferred credits

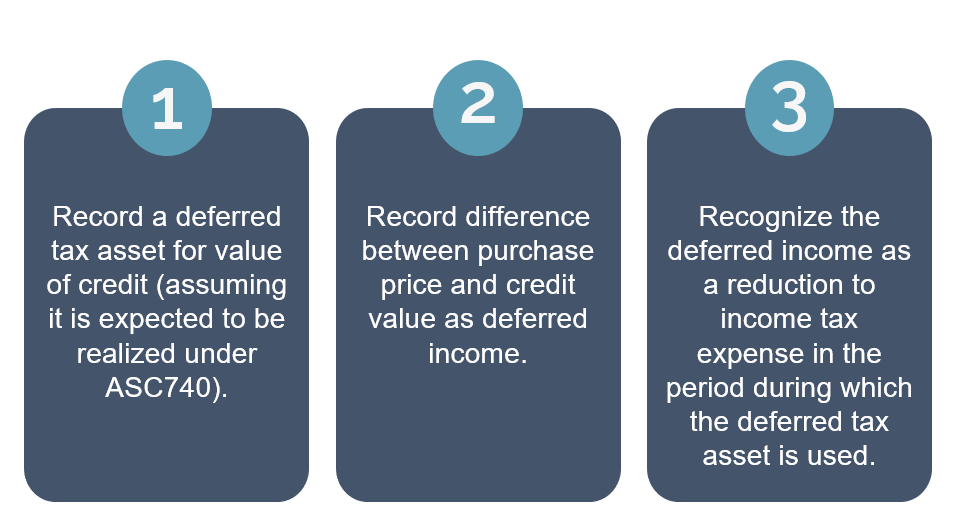

In general, credits will be accounted for under ASC 740. See steps below for tax accounts that are impacted by the purchase of transferable credits.

Conclusion

Financial institutions have a unique opportunity to support and finance many clean energy projects as a result of the Inflation Reduction Act. They can seize on lending opportunities, ESG goals, and tax strategies as a result. Banks also have the unique capacity to buy credits because of their ability to purchase the credits in cash. From there, they can reduce their own tax burden while supporting community clean energy projects. However, careful due diligence and consideration are needed to make sure the credits can be used and that credits meet all the requirements needed to ensure you know you are getting what is in the transfer agreement. We encourage you to partner with your tax advisors and strategists to assist your institution with proper planning and execution of transferring credits. They can lead to myriad savings and benefits, but can result in costly penalties if not treated correctly.

For more information or a discussion on how this may impact your bank, please contact Adam Aucoin or your BNN tax advisor at 800.244.7444.

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.