Month-End Madness: How Nonprofits Can Tackle Common Closing Challenges

Month-end is a challenging time for many nonprofit organizations. The pressure to compile financial information and reports from a variety of systems, coordinate between departments, and balance schedules can be stressful.

How can nonprofits streamline financial practices to achieve both financial excellence and greater mission impact? Balancing financial data management, effectively preparing data, and leveraging technology to enhance efficiency and compliance can help simplify month-end reporting and allow nonprofits to focus on their mission of serving the community.

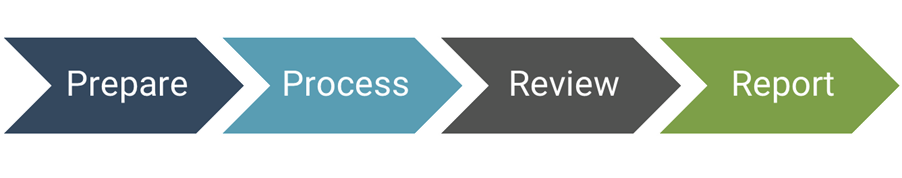

Prepare

A successful month-end close starts with gathering all necessary information and ensuring systems are ready. For nonprofits, this includes checks you received in the mail, all online donations, and any recurring gifts. It will also include reviewing grant calendars to identify upcoming reports and validating program expense coding.

Reconciling income, expenses, and accounting for event sponsorships, ticket sales, and auction proceeds will lay the groundwork for an efficient and effective close. Once you have the records in place it will streamline your ability to work through the next phases because you are not waiting on information.

Process

The next phase focuses on process, which involves recording and characterizing all of your gathered information in the financial statements. Accurate data entry and the use of multi-dimensional coding to enable compliance and meaningful program analysis is critical. For nonprofits specifically, a key component of this phase will be reconciling donation records and evaluating the collectibility of outstanding pledges.

Review

During the review phase, organizations will verify the accuracy and compliance of financial records. Particularly for small departments, it can be beneficial to take a step back after the first two phases to ensure a fresh perspective during the review. This phase includes verifying fund balances, reviewing program and administrative expenses, and performing compliance checks for grant funding. Proper documentation is crucial throughout the review process to ensure transparency and accountability.

Report

The final phase is reporting, where financial data is transformed into meaningful information for stakeholders. Organizations can benefit from generating program-specific reports and financial dashboards in addition to financial statements. For nonprofits, it is also essential to connect financial results to mission impact and provide stakeholders with accurate and timely information.

Be sure to keep the following in mind as you are building and sharing reports:

1. Consider how technology can support your processes

The effective use of technology can pay dividends in streamlining the month-end close process. There is of course a cost associated with quality technology tools; however you will see improvements in accuracy and save your team several hours each month by investing in the right tool for your organization. There are several affordable solutions popular amongst nonprofits, like QuickBooks and Sage Intacct. AI tools, such as ChatGPT, can help quickly generate answers and summaries of reports.

Leveraging technology can help nonprofits focus more on their mission and less on data entry.

2. Ensure clear documentation and consistent application of methodologies

Organizations should consider creating checklists and templates to ensure repeatable procedures and reduce errors. Strong financial controls, such as dual approval processes for expenditures, are important to prevent fraud and ensure proper use of funds.

3. Bring everything back to your mission

Finally, nonprofits should tie their financial practices back to their mission. Celebrating financial transparency and effectively communicating financial stories to different audiences can build trust with stakeholders and enhance donor commitment. Your financial statements and reports should align with the quantitative and qualitative successes from your organization’s work (people served, items donated, impact of community investments, etc.)

By implementing a structured, mission-focused month-end close process, nonprofits can achieve both financial excellence and greater mission impact.

Take hold of your month-end close

The month-end close can be stressful and overwhelming, particularly for small departments juggling a variety of tasks and responsibilities. Applying strategies consistently, following established processes, and leveraging technology can go a long way in streamlining the month-end close process and improve an organization’s financial health. Organizations can also consider working with a trusted Client Accounting and Advisory Services partner to support their internal functions.

Interested in learning more?

BNN’s Client Accounting & Advisory Services team partners with nonprofit organizations to provide tailored outsourced accounting support and strategy. Our advisors develop customized plans for your organization that achieve compliance and free up resources so you can focus on your mission. Our practice prioritizes responsiveness, attention to detail, and a down-to-earth approach to client relationships, collaborating with internal teams and leadership to help reach organization goals. Our experience spans the full breadth of roles in accounting and finance functions, including CFOs, controller, accounting staff, and bookkeepers.

Learn more and start a conversation with our team.

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.