Reflecting on the Adoption of CECL

As we enter the holiday season and approach a new year, we wanted to reflect on the adoption of CECL and share some thoughts heading into the new year. While the Current Expected Credit Losses (CECL) model under Accounting Standards Update (ASU) 2016-13 (Topic 326) has been effective for certain SEC filers for several years now, the standard became effective for many institutions this year. In short, this standard requires institutions to assess, document, and defend the expected credit losses on financial assets measured at amortized cost utilizing historical losses on financial assets with similar risk characteristics, current and past conditions, and reasonable and supportable forecasts.

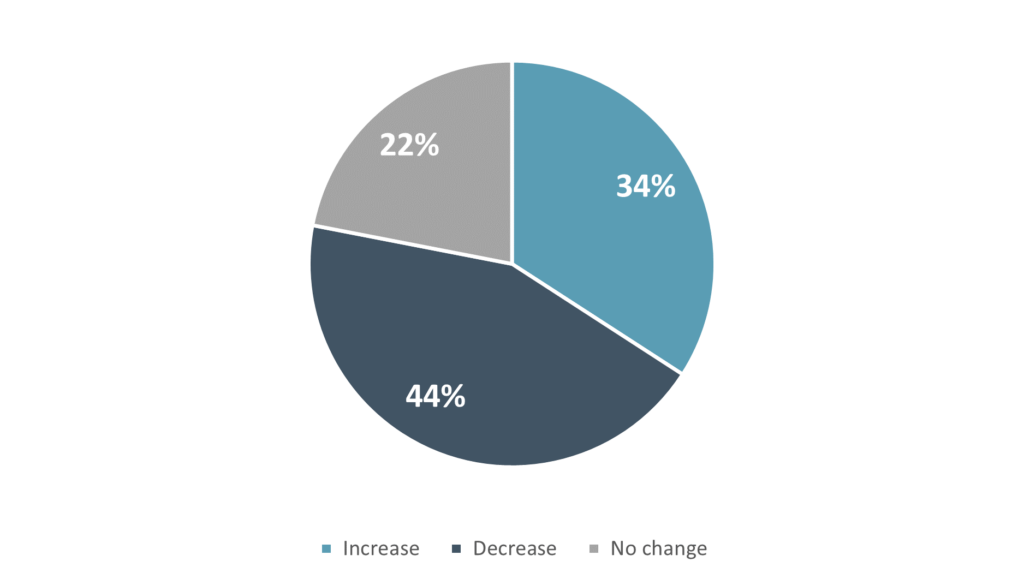

As financial institutions worked through their adoption of the standard, we have observed trends throughout various institutions in the New England area. Based on 41 commercial and savings banks spread across Massachusetts, Connecticut, New Hampshire, Vermont, and Maine, the adoption of CECL has resulted in changes in 78% of the institutions sampled.

Direction of Impact on Allowance at Adoption

Commercial & Savings Banks

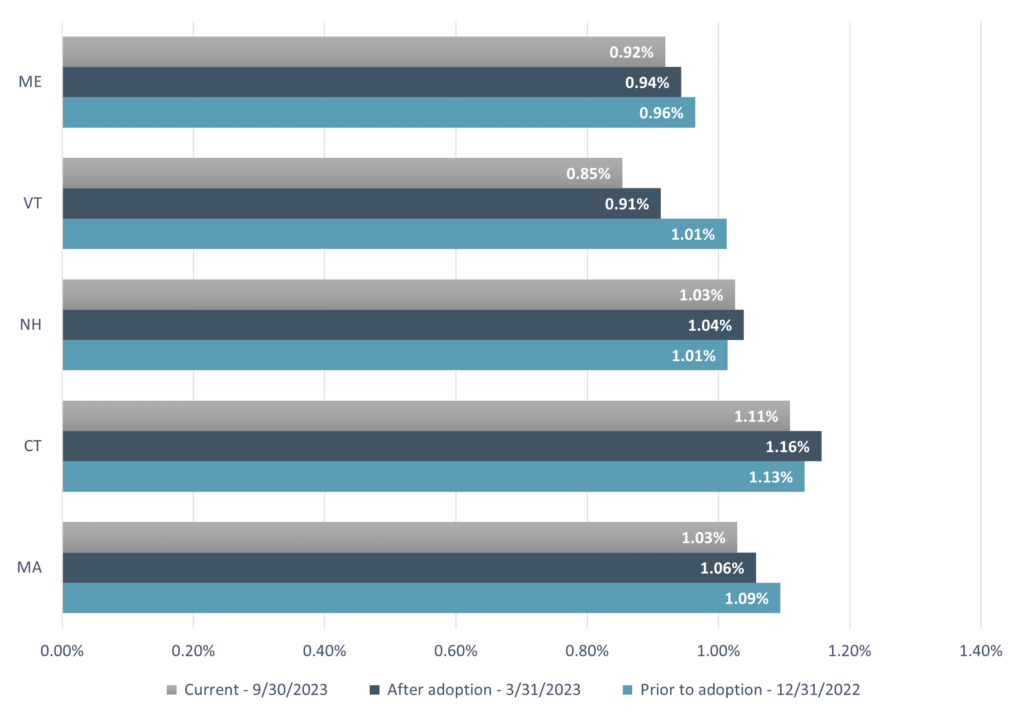

We noted that the average allowance coverage ratio prior to adoption and after adoption has remained consistent for each state, ranging between 0.90% – 1.10% in most instances. Overall, most increases or decreases upon the adoption of CECL were minimal and did not have a significant impact on the allowance balance.

Average Allowance Coverage by State Over Time

Commercial & Savings Banks

While this is what the data shows, based on discussions with various financial institutions there has been a significant increase in effort to document the methodology and various assumptions. As we discussed in a recent podcast in collaboration with Darling Consulting Group, which can be referenced here, the key to a strong calculation is all about having good data and assumptions that go into it.

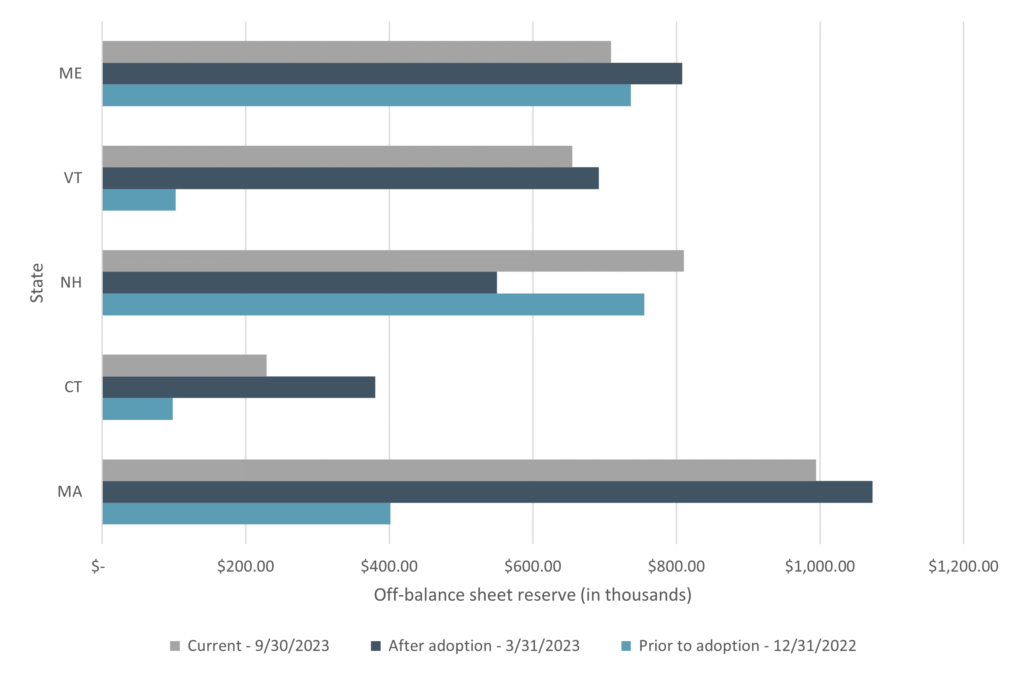

Off-Balance sheet reserve

Where things get a bit more interesting is in the off-balance sheet reserve. In Massachusetts, Vermont, and Connecticut we have seen the most meaningful increases, with a slight increase in Maine and an overall decline in New Hampshire post CECL adoption. This wide range of observations could be due to several factors, including the level of off-balance sheet reserve prior to adoption of CECL, the nature of institutions’ off-balance sheet credit exposures and expected funding rates. Also coming into play is the scope of exposures related to unconditionally cancellable credit. Under Topic 326, if the financial institution has the ability to cancel a commitment to extend credit for any reason, including without cause, this commitment is considered “unconditionally cancellable,” and no credit loss reserve is required. Financial institutions, if they haven’t already, will need to review agreements to ensure credits that fall under this category are appropriately removed from this evaluation.

Off-Balance Sheet Reserve

Commercial & Savings Banks

Saying goodbye to OTTI

Although the CECL conversation has been heavily focused on assets measured at amortized cost (financing receivables, held-to-maturity (HTM) debt securities, etc.) let’s not forget the changes related to available-for-sale securities, which eliminated the concept of other-than-temporary impairment (OTTI) for these debt securities and replaced it with a valuation allowance model which can be adjusted upwards or downwards as changes in expected credit losses occur. If the fair value of an individual security is determined to be less than its amortized cost, the difference should be reported using an allowance, not forgetting that the allowance cannot be greater than the difference between fair value and amortized cost. This is also an important reminder to ensure all policies, procedures, and reporting are updated to include how impairment is identified, how often the evaluation occurs, and removing outdated terminology.

Looking forward to 2024

You may be breathing a sigh of relief and are prepared to put the year of adoption behind you, but there is still work to be done. If you haven’t already, we strongly recommend looking at the required CECL disclosures for the 2023 year-end. In addition to the standard’s requirement to document the analyses and conclusions around the valuation of credit instruments, it also results in substantial changes to the required disclosures within the annual financial statements. Some examples of these changes include, but are not limited to:

- Discussion about how expected loss estimates are developed, and a description of the policies and methodology used to estimate the allowance for credit losses

- Discussion of reversion method applied for periods beyond a reasonable forecast period

- New disclosures related to financial instruments on nonaccrual

- New disclosures related to loans modified to borrowers experiencing financial difficulty

- Credit quality information by year of origination, or “vintage” (public business entities only)

- For collateral dependent financial assets for which the practical expedient has been elected, management must disclose collateral descriptions by class of financing receivable or major security type, the extent of security and significant changes in the collateral

The goal of these changes is meant to provide improvements to the existing disclosures, providing more transparency on underlying assumptions and judgments. To assist in preparing these disclosures and getting a feel for what the readers should expect, BNN’s Banking & Financial Services practice has prepared a set of sample financial institution financial statements, including the new CECL-related disclosure requirements. These illustrative statements can be found here.

Final Thoughts

In summary, the data has shown that although the adoption of CECL has resulted in some increases and decreases in institutions’ reserve levels, the change in overall allowance coverage has remained consistent pre- and post-adoption. We encourage institutions to continue to refine and challenge their models and assumptions as we enter the new year.

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.