Telemedicine, ICD-10-CM Guidelines, and New HCPCS for Testing

Updated May 20, 2020:

Medicare telemedicine update:

The Centers for Medicare and Medicaid Services (CMS) recently announced a waiver of certain telehealth coverage requirements so that beneficiaries can receive a wider range of services from their providers without traveling to their offices. CMS has relaxed the telehealth originating site requirements to include patient homes; the rural Health Professional Shortage Areas (HPSA) / non- Medicare Statistical Area (MSA) county geographic location requirements have been waived so that patients in any geographic location can receive covered telemedicine services.

On March 17, 2020, CMS released the Medicare Telemedicine Health Care Provider Fact Sheet. The expansion of Telehealth with 1135 waiver indicates that Medicare will pay for office, hospital and other visits furnished via telehealth across the country, and including in patient’s places of residence beginning on March 6, 2020. Medicare beneficiaries will be able to receive services including evaluation and management (E&M), mental health counseling and preventive health screenings. Prior to this waiver, Medicare would only pay for telehealth on a limited basis. Telehealth services are paid under the Physician Fee Schedule at the same amount as in-person services.

On April 30, 2020 CMS expanded the list of qualifying telehealth services and waived the video requirement for certain telephone evaluation and management services. Medicare beneficiaries will be able to use audio-only telephones to receive approximately 89 different types of services. (Updated 05/20/2020)

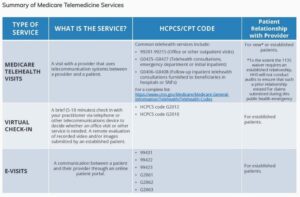

There are three main types of virtual services physicians and other professionals can provide to Medicare beneficiaries summarized in the fact sheet: Medicare telehealth visits, virtual check-ins and e-visits.

Medicare telehealth visits:

- The provider must use an interactive audio and video telecommunications system that permits real-time communication between the distant site and the patient at home

- Visits are considered the same as in-person visits and are paid at the same rate as regular, in-person visits

- Medicare will pay for Medicare telehealth services furnished to beneficiaries in any healthcare facility and in their home

- The Health and Human Services (HHS) Office of Inspector General (OIG) is providing flexibility for healthcare providers to reduce or waive cost-sharing for telehealth visits paid by federal healthcare programs

Virtual check-in:

- Provided to Medicare patients with an established relationship with a provider

- Service may not be related to a medical visit provided within the previous 7 days, and does not lead to a visit within the next 24 hours (or soonest appointment available)

- Brief communication services may be used such as telephone or exchange of information through video or image

- Patient must verbally consent to receive a virtual check-in service

- Healthcare Common Procedure Coding System (HCPCS) code G2012: Brief communication technology-based service (e.g., virtual check-in), by a physician or other qualified health care professional who can report evaluation and management services, provided to an established patient, not originating from a related E&M service provided within the previous 7 days, nor leading to an E&M service or procedure within the next 24 hours, or the soonest available appointment; 5-10 minutes of medical discussion

- HCPCS code G2010: Remote evaluation of recorded video and/or images submitted by an established patient (e.g., store and forward), including interpretation with follow-up with the patient within 24 business hours, not originating from a related E&M service provided within the previous 7 days, nor leading to an E&M service or procedure within the next 24 hours, or the soonest available appointment

- Virtual check-ins can be conducted with a broader range of communication methods, unlike Medicare telehealth visits, which require audio and visual capabilities for real-time communication

E-visits:

- These services can only be reported when the billing practice has an established relationship with the patient

- There are no geographic or location restrictions for these visits

- Patients communicate with their doctors without going to the doctor’s office by using online patient portals

- These services may be billed using CPT codes 99421-99423 and HCPCS codes G2061-G206, as applicable

- The Medicare coinsurance and deductible would generally apply to these services

Note: there is a typo in the table above from CMS. E-VISITS HCPCS/CPT CODE 99431 should be 99421

Regardless of the service provided, documentation and compliance for each service is an important reminder. Things to consider:

- Consent to treat

- Health Insurance Portability and Accountability Act (HIPAA) rules and regulations

- Documentation requirements, including but not limited to, Medical Necessity, History, Exam, Medical Decision Making, and/or time

- Monitoring of services provided prior to, and/or following, virtual visits (bundling of services)

- Document where the provider and patient are located, include circumstance for type of service

Medicare telehealth services are generally billed as if the service had been furnished in-person. For Medicare telehealth services, the claim should reflect the designated Place of Service (POS) code 02-Telehealth, to indicate the billed service was furnished as a professional telehealth service from a distant site.

Information provided is current as of March 17, 2020. Organizations should continue to monitor information provided by CMS and their individual State updates on a daily basis for any changes and/or guidance.

Coding for encounters related to 2019 novel coronavirus (COVID-19):

The Coordination and Maintenance Committee Meeting held on March 18, 2020 announced that the COVID-19 diagnosis code, originally scheduled to become effective October 1, 2020, will now be effective as of April 1, 2020. This new code is U07.1. BNN will provide updates with additional information and coding instructions as they become available.

Until that time, the CDC and cooperating parties have developed and approved the following coding guidance related to COVID-19.

Confirmed COVID-19 conditions are reported with two codes: One for the condition itself, and the other to identify the infectious agent.

- Pneumonia confirmed as due to COVID-19

- 89 Other viral pneumonia

- 29 Other coronavirus as the cause of diseases classified elsewhere

- Acute bronchitis confirmed as due to COVID-19

- 8 Acute bronchitis due to other specified organism

- 29 Other coronavirus as the cause of diseases classified elsewhere

- Bronchitis not otherwise specified (NOS) due to COVID-19

- J40 Bronchitis not specified as acute or chronic

- 29 Other coronavirus as the cause of diseases classified elsewhere

- Lower respiratory infection, not otherwise specified associated with COVID-19

- J22 Unspecified acute lower respiratory infection

- 29 Other coronavirus as the cause of diseases classified elsewhere

- Respiratory infection NOS associated with COVID-19

- 8 Other specified respiratory disorders

- 29 Other coronavirus as the cause of diseases classified elsewhere

- Acute respiratory distress syndrome ARDS due to COVID-19

- J80 Acute respiratory distress syndrome

- 29 Other coronavirus as the cause of diseases classified elsewhere

- Exposure to someone with confirmed COVID-19

- 828, Contact with and (suspected) exposure to other viral communicable diseases.

- Possible exposure to COVID-19 which is ruled out after evaluation

- 818, Encounter for observation for suspected exposure to other biological agents ruled out

- Signs and Symptoms: Report for encounters when definitive diagnosis has not been established

- R05 Cough

- 02 Shortness of breath

- 9 Fever, unspecified

As most cases to-date have been respiratory in nature, B34.2 Coronavirus infection, unspecified would generally not be appropriate to assign.

If the provider documents “suspected”, “possible” or “probable” COVID-19, do not assign code B97.29.

Assign a code(s) explaining the reason for encounter (such as fever, or Z20.828).

Payment rates for new COVID-19 lab tests:

Medicare has recently released a communication for two new HCPCS codes for the billing of laboratory tests related to COVID-19:

- U0001: Used by providers who are specifically using the Center for Disease Control and Prevention (CDC) 2019 Novel Coronavirus Real Time RT-PCR Diagnostic Test Panel

- Medicare Reimbursement (MAC JK): $35.91

- U0002: 2019-nCoV Coronavirus, SARS-CoV-2/2019-nCov (COVID-19) testing, any technique, multiple types or sub types (including all targets). These are non-CDC laboratory tests.

- Medicare Reimbursement (MAC JK): $51.31

- 87635: Infectious agent detection by nucleic acid (CAN or RNA); severe acute respiratory syndrome coronavirus 2 (SARS-Co-2) (Coronavirus disease [COVID-19]), amplified probe technique

- Available for dates of service on or after March 13, 2020

- Medicare Reimbursement (MAC JK): $51.31

If you have questions on this topic, please contact your BNN healthcare advisor at 800.244.7444.

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.