The OIG Work Plan: Don’t be caught unaware

What is the OIG Work Plan?

The U.S. Department of Health & Human Services (HHS) Office of Inspector General (OIG) Work Plan is an essential resource for healthcare compliance professionals to assist in identifying risk for their organization. These risks can take many forms, such as fraud, waste, abuse, and mismanagement. The OIG Work Plan identifies projects, including OIG audits and evaluations, that are in process or scheduled during the fiscal year and beyond by the Office of Audit Services and Office of Evaluation and Inspections.

Where can I find the work plan?

The work plan can be found on the HHS OIG website here, or on the OIG website under reports. The plan details a lot of information and specifics. If you need assistance with navigating this document and the requirements, consider reaching out to a dedicated healthcare industry specialist, like the team at Baker Newman Noyes.

What is included in the work plan?

Medicare Risk Adjustment is on the work plan!

Medicare Risk Adjustment (MRA) refers to the process of adjusting Medicare patient risk scores according to diagnostic codes assigned by healthcare professionals. Risk adjustment is critical so that health plans are adequately funded to meet patient needs. The process of risk adjustment also ensures that regardless of a patient’s demographic information, funds to provide care for Medicare beneficiaries with complex medical conditions will flow from the Center for Medicare and Medicaid Service (CMS) to the beneficiary’s health plan to pay providers for medical services.

Risk adjustment ensures providers are paid adequately to care for patients, regardless of their health status. For example, if a health plan has a higher-than-average percentage of patients with chronic illnesses, it will receive higher risk-adjusted payments.

The goal of risk adjustment is for patients to have their chronic conditions effectively and efficiently managed by their providers, leading to better healthcare outcomes. It also aims to enable more accurate comparisons across healthcare networks that treat beneficiaries of varying clinical complexity and to predict healthcare costs by equating a person’s health status to a risk score.

Complete and accurate reporting allows providers to improve the overall patient healthcare evaluation process, enhance communication with a patient’s healthcare team, and identify the complete picture of a patient’s health status. It also reinforces self-care and prevention strategies, coordinates care in a collaborative manner, and helps avoid potential drug-drug or disease interactions. Additionally, it confirms compliance with CMS obligations, which include using all diagnosis coding guidelines and standards in medical record documentation, reporting all conditions and diagnosis codes present on the date of an encounter, and participating in CMS Medicare Recovery Audit Contractor (RAC) and Risk Adjustment Data Validation (RADV) audits.

The final result, regardless of the risk adjustment model used or the individual scoring process, is that an overall risk score is calculated for each patient. Final risk scores are always influenced by known diagnoses, and diagnosis codes carry value and are generally cumulative. Risk scores can be grouped by patient population or combined to identify the risk of an entire health plan. Inaccurate risk scores from over- or under-coding can have dramatic financial impacts on a health plan’s payments, a provider’s payments, and the ability to adequately care for patients with certain conditions.

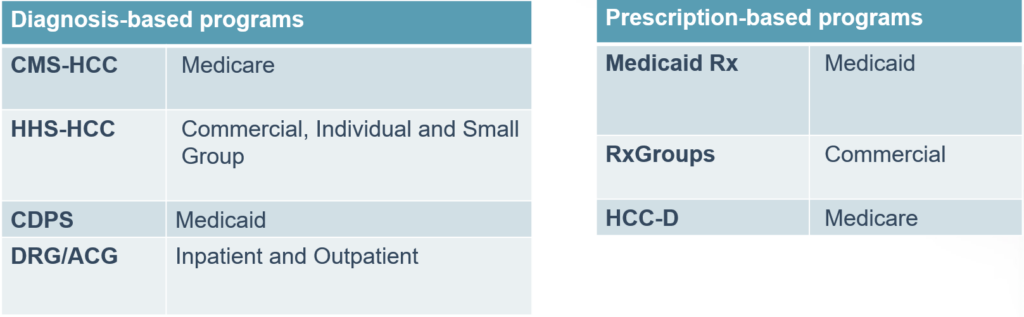

Below are some examples of risk adjustment models:

Why does this matter?

Payments to Medicare Advantage (MA) organizations are risk-adjusted based on each enrollee’s health status (SSA § 1853(a)). MA organizations are required to submit risk adjustment data to CMS according to CMS instructions (42 CFR § 422.310(b)). CMS allows MA organizations to conduct chart reviews of enrollee medical record documentation to identify diagnosis codes that providers either:

- did not originally provide the MA organization or

- provided the MA organization in error.

For some chart reviews known as unlinked chart reviews, CMS does not require that the MA organization identify the specific date of service for previously unidentified diagnosis codes. CMS also allows MA organizations to submit chart review results to CMS for inclusion in calculating each enrollee’s risk score., which allows providers to identify the diagnosis codes that may not have been submitted or that may be incorrect. Miscoded diagnoses may cause CMS to overpay MA organizations.

For these audits, the OIG will focus on enrollees who had diagnoses identified from unlinked chart reviews that resulted in increased risk-adjusted payments from CMS to MA organizations. For these enrollees, OIG will determine whether all of the diagnosis codes that the MA organizations submitted to CMS for use in CMS’s risk adjustment program, including the diagnosis codes submitted via unlinked chart reviews, complied with federal requirements.

Will you be prepared for this audit? Do you have a current policy and procedure in place? Do you review and audit internally to validate you are complying?

Want to learn more?

The BNN Healthcare Advisory team specializes in proper billing and coding guidance across the continuum of care. If your healthcare organization is experiencing challenges with Medicare risk adjustment, looking to better understand the reviews detailed in this article, or interested in learning more about improving your processes, technology, and strategy, get in touch with our healthcare industry specialists today! You can also learn more about our healthcare industry solutions here.

Disclaimer of Liability: This publication is intended to provide general information to our clients and friends. It does not constitute accounting, tax, investment, or legal advice; nor is it intended to convey a thorough treatment of the subject matter.